- Student Housing Daily

- Posts

- Student Housing Daily - July 22 - Timberline acquires student housing for $82M

Student Housing Daily - July 22 - Timberline acquires student housing for $82M

CBRE arranges sale of 260 beds. HH Fund secures $21M bridge loan. Berkadia expands student housing team. Common student housing marketing mistakes. Four new student housing deals.

Good morning. This is Student Housing Daily, and we finished early.

→ We are here to serve the owners, brokers, managers, and capital providers that specialize in student housing. Do us a favor, and forward this email to your favorite student housing pro. They can sign up here.

Now, let’s get to it.

NEWS ROUNDUP

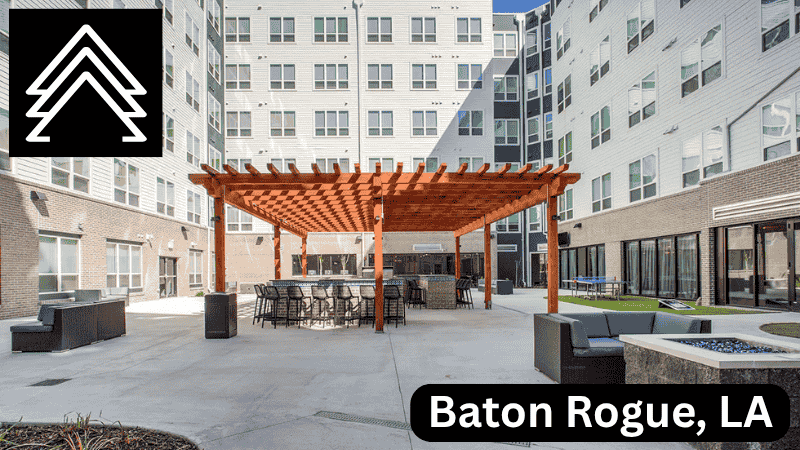

ACQUISITION: Timberline acquires student housing for $82 million. Timberline Real Estate Ventures has acquired Park Place, a 280-unit student housing complex near LSU’s South Gates, for $82 million ($292,857/unit). The property was purchased from Park7 Group via Bla Owner. Andrew Stark, principal at Timberline, represented the buyer, while Arthur Hooper Jr. represented the seller. The deal marks Timberline’s second major student housing acquisition in Baton Rouge this year, following its $25.1 million purchase of The Oliver on Burbank Boulevard in February. Park Place, developed in 2017 at a construction cost of roughly $42 million, features upscale amenities including a rooftop pool with a hot tub and a jumbotron. Park7 Group originally acquired the 2.6-acre site on East Boyd Drive for $9.3 million in 2015.

DISPOSITION: CBRE arranges sale of 260 beds. CBRE has arranged the sale of Warehouse & Factory, a 260 bed property serving the Texas A&M University. CBRE’s Jaclyn Fitts, Casey Schaefer, William Vonderfecht, Carson Ford, Eduardo Gamez, Sully Keeley, Jack Johns, Hank Carpenter, Maria Pas, Brad Peters, and Victoria Langston handled the sale.

FINANCING: HH Fund secures $21 million bridge loan for student housing conversion project. HH Fund has secured a $21 million bridge loan from M&T Realty Capital to finance the conversion of The Lanes at Union Market, a 110-unit multifamily property in Washington, D.C., into student housing. The two-year, interest-only loan will provide HH Fund the flexibility to complete its repositioning strategy. The property was acquired at a foreclosure auction in July for $38.3 million, on behalf of EagleBank, with Ranger Properties as the seller. The 11-story building, delivered in 2023, features one- to three-bedroom floorplans, many with private balconies or patios, and includes retail space on the ground floor. Since acquisition, HH Fund has been working with local universities to convert the building into student housing. Currently, about 50% of the units are occupied by students, with further leasing underway. The financing was led by Dan Lynch (Senior Vice President), Joanie Wilson (Deputy Chief Credit Officer), and Connor Quigley (Vice President) of M&T Realty Capital.

PEOPLE MOVES: Berkadia expands student housing team. Berkadia has appointed Travis Prince as Senior Managing Director to co-lead the firm’s national student housing investment sales platform alongside Kevin Larimer. Based in Tampa, Florida, Prince will focus on the acquisition and disposition of student housing properties across the U.S., while also advising on portfolio analysis, capital stack structuring, and joint venture strategies. Prince joins Berkadia from Cushman & Wakefield, where he led the firm’s national student housing capital markets team and built a reputation as one of the sector’s foremost experts. “Recognized as an industry leader in the student housing sector, Travis brings a client-focused approach and a robust national network of resources,” said Mike Miner, SVP and Co-Head of Investment Sales and Production Operations at Berkadia.

THE SMART MONEY IS IN ALTS

The team behind Student Housing Daily just launched CREalts, the single news source that covers 30 niche CRE segments.

One scroll every morning keeps you up to date on all the transactions, trends, and capital movements in alts.

Click here to subscribe: Subscribe to CREalts.

STUDENT HOUSING FOR SALE

Click each image for more information:

517 Beds | 81% Occupancy | Cottage-Townhomes | 83% Preleased For AY ‘25-’26 | Resort Amenities | CFO: July 24

528 Beds | 93.94% Preleased For AY ‘25-’26 | Ownership Has Invested $839,651 Over the Past Three Years | Potential to Unlock Additional $679K in Revenue | CFO: July 24

2 Properties | 6 Beds | Fully Leased Through 2026 School Year | Sold Together or Individualy

599 Beds | 97% Occupancy | 65% Preleased For AY ‘25-’26 | Close to Campus

ONE MORE THING

Why haven’t we developed bigger rice?

Rice is very small. Wouldn’t it make more sense if each grain was like 8 oz? Then you would only have to eat a couple of rice.

— East Village Guy (@eastvillageguy)

4:34 PM • Apr 16, 2025

→Try our resources for student housing pros:

Search Properties (beta) | Student Housing News | Comps (coming soon) | Professional Network (coming soon) | Advertise Listings | Share a Closing Announcement